Funding Your Startup in St. George: Grants, Loans & Credit Options

Opening the Funding Floodgates

Starting a business here in St. George can be exciting, but we all know that getting the right funding early on can make all the difference. Thankfully, our area has more resources than many realize — from local grants and small business loans to state-supported credit initiatives designed just for Utah entrepreneurs. I’ve found that once you know where to look, a world of opportunity opens up.

Whether you’re in the early stages of a tech startup or ready to expand a small retail business, there are targeted programs to help you get started and sustain growth. The key is matching your business type and goals with the right kind of funding opportunity.

Understanding Your Funding Options in St. George

Funding in St. George comes in several forms, each catering to different needs. According to the startup funding programs in Utah, you can access:

- Small business grants – These are funds you don’t have to repay, often awarded for innovation, job creation, or work in priority industries.

- Bridge loans – Short-term financing options to keep things moving while you secure longer-term funding.

- Credit initiatives – Such as the Utah Small Business Credit Initiative, which can help expand your access to capital through participating lenders.

- Private investment – From angel investors in St. George to venture capital firms active in Utah.

There are also tailored loans from local financial institutions like Zions Bank and America First Credit Union, and specialized funds such as the Utah Microenterprise Loan Fund for smaller-scale ventures.

Qualifying for Local Grants and Loans

While the opportunities are plentiful, each comes with eligibility requirements. Many programs in Washington County require your startup to be registered in Utah and demonstrate:

- A viable business plan.

- Potential for growth, innovation, or local job creation.

- In some cases, a focus on certain industries like technology or renewable energy.

For example, information on small business grants in Saint George shows that a clean credit history is often preferred, and women, minority, and rural business owners may have access to dedicated funding pools. It’s always wise to meet with an advisor from organizations like SCORE St. George or the St. George Chamber of Commerce to determine which programs you can realistically pursue.

Top Funding Programs and Resources

A few programs and resources consistently stand out for local entrepreneurs:

- Utah Small Business Credit Initiative – Federal funds allocated to increase access to capital.

- Utah Tech Business Resource Center – Sponsored by Zions Bank, providing no-cost business consultations and funding navigation.

- Utah Small Business Development Center – Offers training, consulting, and application guidance.

- Private Investment Firms – Like UpStart Life Sciences Capital, particularly focused on early-stage companies tied to research universities.

You can explore a full directory of resources for Utah entrepreneurs that lists startup incubators in southern Utah, business mentorship programs, and additional seed funding opportunities.

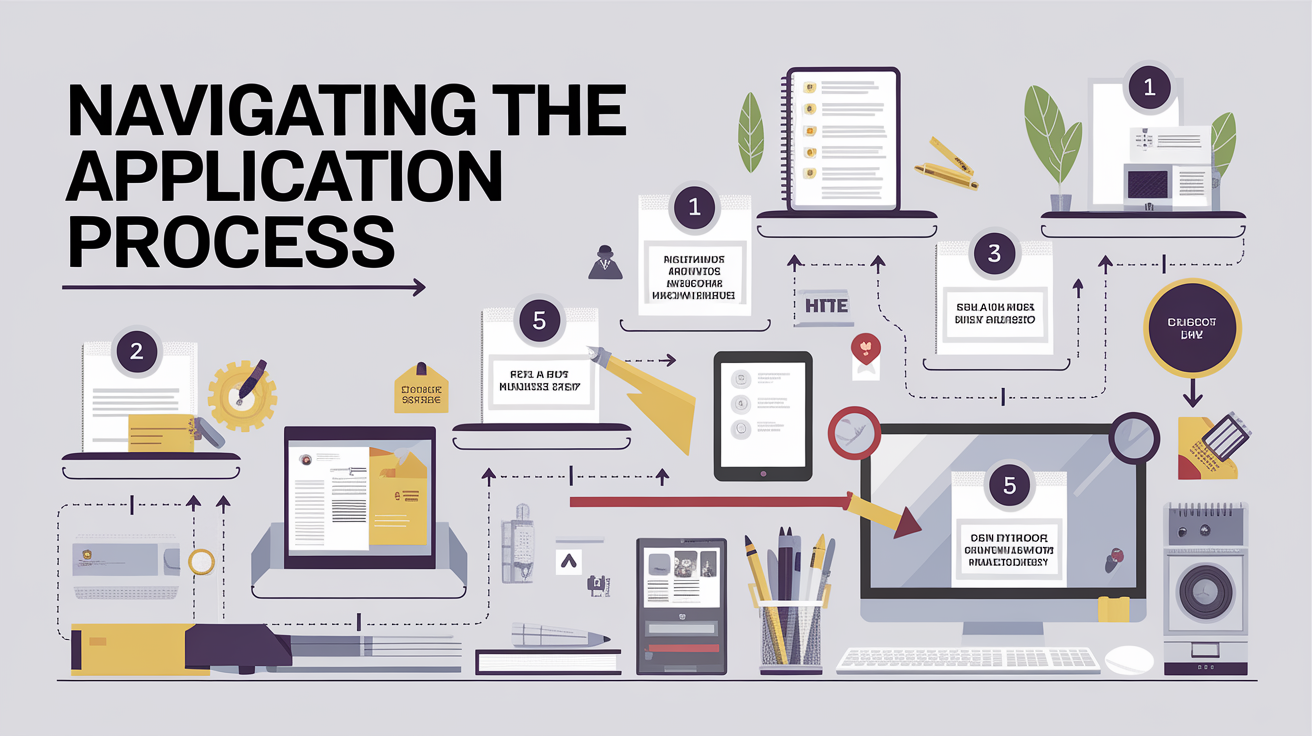

Navigating the Application Process

Applying for grants or loans can feel daunting, but breaking it into steps makes it manageable:

- Research thoroughly – Identify programs you’re eligible for through local, state, and private listings.

- Prepare your documents – Have a polished business plan, financial statements, and, if needed, tax records ready.

- Seek guidance – Take advantage of free mentoring and workshops via the St. George Chamber of Commerce, SCORE, or the Utah Department of Workforce Services.

- Apply early and follow up – Many programs have annual or quarterly funding cycles, and timely, accurate submissions improve your chances.

Some grants require detailed descriptions of how funds will be used, so be as specific as possible. Remember — lenders and grant reviewers want to see how their investment in your business helps the local economy.

Funding Your Future: Next Steps for St. George Entrepreneurs

St. George’s startup scene is growing quickly, with companies like Zonos and PrinterLogic showing what’s possible. The city’s strong ranking on the global startup map reflects both the business-friendly environment and the availability of useful funding resources.

If you’re wondering how to get startup funding in St. George, your best starting point is to connect with local business development programs and gather information on applicable grants, loans, and credit options. This way, you can build strong financial foundations and take advantage of networking, mentorship, and possible incentives like Utah startup tax credits or commercial real estate benefits.

With the right mix of preparation and persistence, you can tap into the wealth of support available here — and turn your startup dreams into a thriving reality right in the heart of southern Utah.